The 7th Pay Commission (7th CPC) is a government-appointed committee that recommends changes to the salary and benefits of central government employees. The Commission complements its recommendations, affecting millions of employees across the country. As a central government employee, you may wonder how the 7CPC will affect your salary. Fortunately, there is a tool that can help you calculate your new salary: the 7CPC salary calculator.

The 7CPC salary calculator is an online tool that considers your current salary, grade pay, and other factors to calculate your new salary under the 7CPC. The calculator is easy to use and can give you an accurate estimate of your new salary. To use the 7CPC salary calculator, enter your current salary, grade pay, and other relevant information. The calculator will generate a new salary estimate based on the 7CPC recommendations.

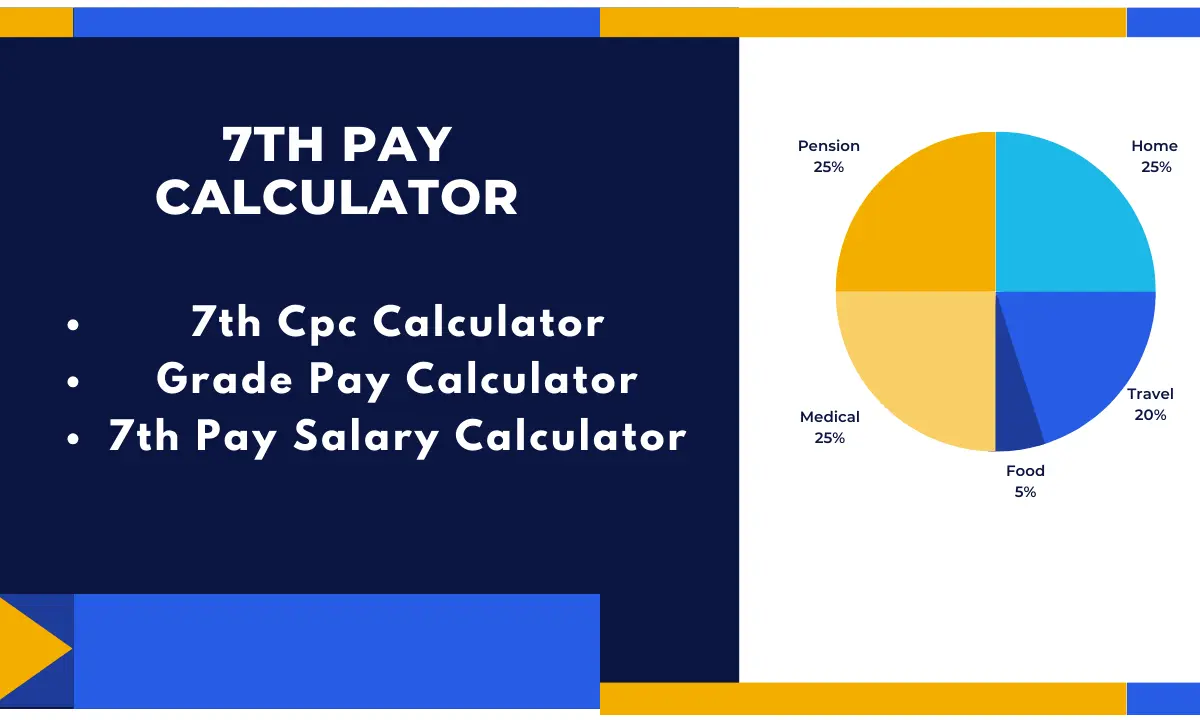

7th Cpc Calculator

The 7th Central Pay Commission (CPC) was implemented by the Indian government in 2016. It aimed to revise central government job employees’ pay scales and allowances. The 7th CPC Calculator is a tool that helps central government employees calculate their salary as per the revised pay scales. The 7th CPC Calculator considers basic pay, grade pay, allowances, and deductions. It provides an accurate estimate of an employee’s salary after the implementation of the 7th CPC.

The 7th CPC Calculator is easy to use and can be accessed online. It is a useful Calculator for central government employees who want to know their revised salary before implementing the 7th CPC. The 7th CPC Calculator has been designed to ensure employees receive their due salary per the revised pay scales. It is a transparent tool that helps employees understand how their salaries are calculated.

7th Pay Commission Salary Calculator 2023

The 7th Pay Commission was implemented by the Indian government in 2016, which increased the salaries of government employees. The new pay structure has been designed to provide better employee remuneration and keep up with the rising cost of living. However, calculating the new salary structure can be daunting, especially for those unfamiliar with the new pay structure.

This is where the 7th Pay Calculator comes in handy. It is a tool that helps you calculate your salary based on the new pay structure. The calculator considers your basic pay, grade pay, and other allowances to give you an accurate estimate of your new salary. The 7th Pay Calculator is easy to use and can be accessed online. All you need to do is enter your basic pay, grade pay, and other allowances, and the calculator will do the rest. It will calculate your new salary, including the arrears you are entitled to.

7th Pay Commission Calculator

The 7th Pay Commission Calculator is a tool designed to help government employees calculate their salaries according to the recommendations of the 7th Pay Commission. The CommissiCommissioned by the Indian government to review and recommend changes to the salary structure of government employees.

The calculator considers various factors, such as the employee’s grade pay, basic pay, and allowances, to calculate their net salary. It also considers any arrears that may be due to the employee. The 7th Pay Commission Calculator has been a boon for government employees, making it easier for them to understand their salaries and plan their finances accordingly. It has also helped to reduce the confusion and uncertainty that often arises when there are changes to the salary structure.

7th Pay Commission Salary Calculator

The 7th Pay Commission Salary Calculator is a tool that helps government employees in India calculate their salary per the recommendations of the 7th Pay Commission. The 7th Pay Commission was constituted by the Government of India in 2013 to review and recommend changes in the salary structure of government employees.

The 7th Pay Commission Salary Calculator considers various factors such as basic pay, grade pay, allowances, and deductions to calculate the net salary of an employee. It is a user-friendly tool that can be accessed online and is available for free. The 7th Pay Commission Salary Calculator has been a boon for government employees, making it easier for them to understand their salary structure and plan their finances accordingly. It has also helped reduce the discrepancies in government employees’ salary structure.

7th Pay Salary Calculator

The 7th Pay Commission was implemented by the Indian government in 2016, which increased the salaries of government employees. However, calculating the revised salary can be daunting, especially for those unfamiliar with the new pay structure. This is where the 7th Pay Salary Calculator comes in handy.

The 7th Pay Salary Calculator is an online tool that helps government employees calculate their revised salary per the new pay structure. All you need to do is enter your basic pay, grade pay, and other relevant details, and the calculator will generate your revised salary as per the 7th Pay Commission.

This tool is not only useful for government employees but also for those who are planning to join the government sector. It helps them understand the pay structure and the benefits of working in the government sector.

Grade Pay Calculator

Government employees in India use the Grade Pay Calculator to determine their salary. It helps them calculate their pay based on their pay grade and years of service. Now, How do you calculate Grade pay? You select your pay grade, determined by your job role and responsibilities. Then, you input the number of years you’ve been in service. The calculator then estimates your monthly salary, including any allowances or bonuses you might be eligible for. This grade pay calculator makes it easier for employees to plan their finances and understand how their salary evolves. It’s a valuable resource for those working in the Indian government sector.

How to Calculate Salary from Grade Pay?

First, add your basic pay and grade pay together to calculate your salary from grade pay. This combined figure constitutes your starting point. Subsequently, factor in any additional allowances, summing them up to derive the total amount. However, it’s essential to be aware of potential deductions, such as taxes. Subtract these deductions from the total to obtain your net salary amount. This comprehensive approach ensures an accurate and thorough salary calculation based on grade pay.

Leave a Reply